So what is interest ?,

Quite simply, interest is a rate of return given to a saver or investor paid by a financial institution. Which is paid on a sum of money earned or borrowed.

It is typically expressed an a % figure on the sum or initial principle sum.

If you save money through a savings product, you will receive a return on that sum of money. In the form of so-called interest. This could be in the form of simple savings accounts with a bank or building society, current accounts, fixed term savings or bonds.

If you borrow money in the form of a bank loan, you will then pay interest to that organisation to cover the cost of borrowing that initial sum. This could be associated with bank loans, credit cards, mortgages, car loans to name a few.

The rates of interest you receive or paid out to a company is usually set by them. It will be ultimately determined by the controlling financial institutions in that country. So for the UK rates will be set by the MPC (Bank of England) or in the USA (Federal Reserve).

Understanding how interest rates work for savers:

Interest compensates one party for incurring risk and reward for sacrificing the opportunity to use funds. While penalising another 3rd party for using someone else’s funds. The person temporarily parting ways with their money is entitled to compensation. The person temporarily using those funds is often required to pay this compensation.

So a simple example:

When you leave deposit your money in a savings account with a bank or building society. Your account will be credited with interest. This is because the bank uses your money and loans it out to other clients, resulting in you earning interest revenue. Obviously the banks will then invest that money elsewhere to generate profits. You will then be rewarded a portion of those profits.

Advantages and Disadvantages of receiving Interest:

A simple strategy for many investors is to receive bank interest. Often a fixed amount, interest often provides positive cash flow that is a reliable source of income. Which will depend on the creditworthiness of the person borrowing the money.

Instead of having capital sitting around and not being used. The idea of lending money to others is a more efficient way of deploying capital elsewhere. In the initial period, when the lender may need that money for a specific reason in the longer term.

Interest is also touted as one of the simplest forms of passive income. It will be paid out monthly or annually. But it isn’t restricted to trading your time for stated return. You can earn money in your sleep.

There are some downsides to collecting interest. First, any interest you receive may become taxable. Even a tiny amount may push a taxpayer into a higher tax bracket.

At present, everyone has a Personal Savings Allowance (within the UK)

You may also get up to £1,000 of interest and not have to pay tax on it, depending on which income tax band you belong to.

To work out your tax band, add all the interest you’ve received to your other income.

| Income Tax band | Personal Savings Allowance |

|---|---|

| Basic rate (20%) | £1,000 |

| Higher rate (40%) | £500 |

| Additional rate (45%) | £0 |

This could include the following sources:

- bank and building society accounts

- savings and credit union accounts

- unit trusts, investment trusts and open-ended investment companies

- peer-to-peer lending

- trust funds

- payment protection insurance (PPI)

- government or company bonds

- life annuity payments

- some life insurance contracts

Savings in tax-free accounts like Individual Savings Accounts (ISAs) and some National Savings and Investments accounts do not count towards your allowance.

Also, because you are collecting interest, this means you are allowing someone else to use your capital. Though you may be satisfied collecting interest, there will often be greater earning potential had you utilised the capital yourself. It’s just that many people don’t know how to invest or are unwilling to make those speculative investments.

So how do rates work for borrowers:

The amount of interest a person must pay is often tied to their creditworthiness. The reliability to repay, how long is the term of the the loan. What purpose is it being used for, so the reason or nature of the loan. The level of interest and interest rates are higher when there is greater risk. Because the lender faces a greater risk of the borrower being unable to make their payments. They may well charge a higher rate of interest to incentivise someone to provide that loan.

As far as the backs or building societies go, once loans are set-up. They require very little to no administration or maintenance after signing the agreement. Lenders may simply collect interest and principal payments.

A starting point to see if you had a good credit report may be to use a free company, such as https://www.creditkarma.co.uk This will provider details of how much you can borrow and the rates applicable to you. It will also give you tips and pointers to improve your credit ratings so you may borrow money at lower rates.

How can I calculate the rate of interest applicable ?

In its simplest format, interest is calculated by multiplying the outstanding principal by the interest rate.

Interest = Interest Rate × Principal or Balance

The more complex aspect of calculating interest is often determining the correct interest rate. The interest rate is often expressed as a percentage and is usually designated as the APR. The rate of APR does not reflect any effects of compounding.

Instead, the effective annual rate is used to express the actual rate of interest to be paid.

Often, an annual rate must be converted to calculate the applicable interest earned in a given period. For example, if a savings account is to pay 6% interest on the average balance, the account may award 0.5% (6% / 12 months) each month.

The applicable interest rate is then multiplied against the outstanding amount of money related to the interest assessment. For savings this is often the average balance of savings for a given period relating to that respective financial product.

It’s slightly different for loans, in that they use the initial principal sum given out to a client. balance.

Are their any disadvantages of Paying Interest

Paying interest means that person or payer is holding debt. Or building up their credit history, and potentially effectively using leverage.

Simple illustration: We all need a mortgage to buy own main residence as it is simple unaffordable to most people when purchasing. Or you could be a property or real estate developer. Who often needs large sums of borrowed money to construct new buildings or improve existing dwellings.

If the rate of return on the building is greater than the interest rate they are charged, the company is successfully. In that they have used someone else’s money to make money for themselves and improve their own financial position.

On the downside, interest is a recurring cash expense. Payers are often contractually obligated to pay interest, and monthly payments are typically applied to interest assessments before paying down the principal.

Consumers may find interest the monthly payments of interest rates being charges unaffordable or overwhelming. They could become stuck in a vicious or never ending cycle, and once they are on that hamster wheel meeting payments, they are unable to step away form that situation. Also, having too many loans in place. Or monthly payments that are too high may restrict a borrower from being able to take out more credit. As an institution may seem them as unworthy or not being able to repay or surface that debt.

The last thing a financial organisation wants is to write off that debt. As they will be seen as losing money, which isn’t very good for that business. It will result in lower profits, bigger write-offs and they then may have to make other decisions in other areas could could affect it moving forwards through growth or expansion.

What is compounding ?

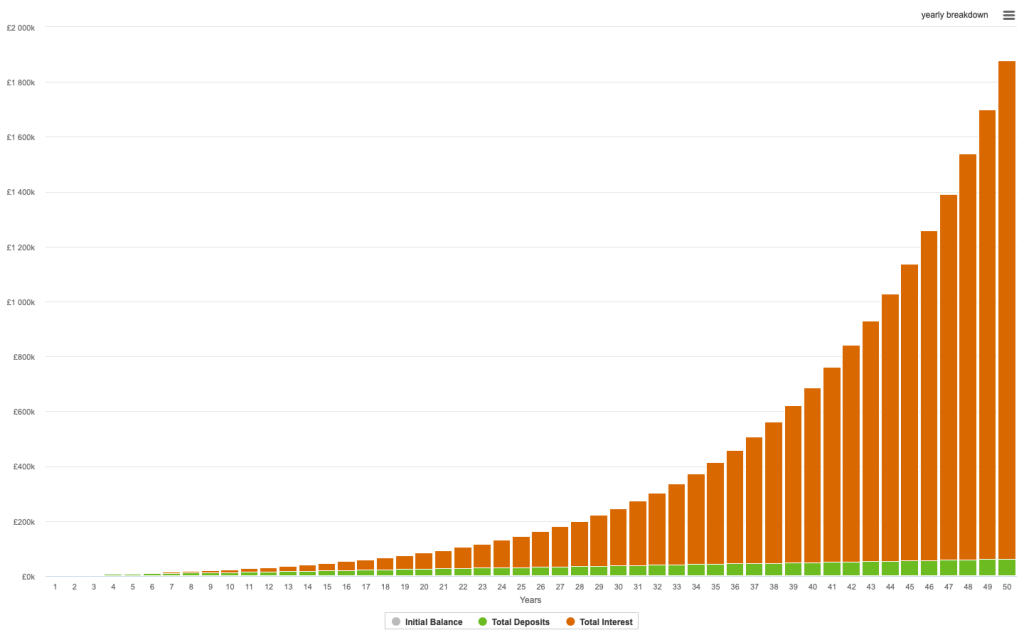

Compound interest is the magic ingredient for savers looking to grow long-term investments. It was once described by Albert Einstein as “the eighth wonder of the world”, compound interest is basically interest that you earn on the interest that’s already built up on your savings or capital investment. The longer that your money is saved or invested by you, it will compound over time.

The beauty is that it could turn a relatively small sum into a much larger amount if left untouched for many years. Because it works by accumulating over time, compound interest can turn a small sum into a significant amount when left untouched.

The following graphic shows how a small sum can grow very rapidly over the latter years.

How can I work out the rate of compounding ?

Instead of paying out the early interest on your savings, compound interest works by reinvesting it. Then the next time interest is calculated its earned on the principal sum, plus the interest you’ve previously accumulated, and so on.

So, if you pay £1,000 into a savings account or fund with interest growth of 6% per year.

You’ll earn £60 interest in year 1, in year 2 you earn £63.60 interest and £67.41 interest in year 3.

These figures may only seem small at present and increase by a relatively small amount but over the course of many years. Those figures will increase by much larger sums year on year.

Remember, with compounding the earlier you start the greater the effect.

Remember:

If you found this blog post useful or informative. Please feel free to check out my other post on https://moneyminted.co.uk which covers pensions, savings, recommended investing books. So you too can improve your financial knowledge and ultimately reach your investing and financial goals.

Be the first to reply