So do do I build a simple Investment portfolio ?

For those of you new to investing. The idea of creating an investment portfolio may seem daunting and frightening but it shouldn’t be.

You need to get the basics right and it ultimately depends on 2 things when starting out.

- Your attitude to risk

- level of investment knowledge

These 2 main factors alone will determine how you start off. They will determine in where you are going to invest any initial savings, nest egg or ongoing monthly contributions.

Before you start out investing, the 1st thing anybody should do is to create an emergency fund. Which may be 3 months worth of bills and regular expenses. Or a set amount of money which you are happy with.

I personally like a minimum of £ 1,000 is cash for a rainy day account.

Which I can get instantly if required. Other people may want a higher amount but I am happy with that amount based on my risk tolerance.

So where should we put our investments ?

Cash: 10%

On that basis you may wish to hold around 10% in a simple cash deposit account. Or within a cash ISA to avoid paying tax on any interest, which may be for instant access.

It can be used for events such as holidays, car repairs, school trips for the children, birthday’s, Christmas etc.

Or it could be held as part of a buying opportunity. Whereby you could take advantage of when the market may have a short term downturn. You may see it as a great opportuntity to buy into the markets at depressed levels. As you may be able to buy shares, funds, ETF’s as a reduced price.

ETF’s: – 50%

If you are new to investing you may wish to start out buying the whole of market. By buying a simple ETF product. Now this may cover a specific sector or country such a the FTSE 100 covering the UK, or the S&P 500 covering the top 500 listed companies in the USA.

Or possibly a global tracker which covers the whole world. Which will reduce the level of investment risk and create greater diversification across your holdings.

Now these funds are normally done on a collective basis. Plus the management and buying fees will be extremely lower than active managed funds.

Some providers will offer reduced rates of say £1.50 dealing fee irrespective of the size of your deal. Whether that may be £ 100 or £ 1,000 as a simple example.

You can just learn to avoid market noise and switch off. As a simple analogy the S&P 500 has produced an average return of 8% since inception.

Remember you will have good years and bad years. So learn to ignore short term market sentiment. You will be rewarded handsomely for thinking long term and letting your investments compound over numerous years.

Example: 2 simple funds that I use.

1st) Is an Adventurous fund offering by my platform provider. It has a fee of 0.31% and has produced an annual return of nearly 8% for the past 5 years.

It invests in around 20 indexes with the largest holding being the S&P 500 at 19% of the fund portfolio, 19% in emerging markets, 16% in FTSE 100.

2nd) Another fund I have been purchasing recently id the Fidelity World Index (Acc fund)https://www.google.com/url?sa=t&source=web&rct=j&opi=89978449&url=https://www.fidelity.co.uk/factsheet-data/factsheet/GB00BJS8SJ34-fidelity-index-world-fund-p-acc/key-statistics&ved=2ahUKEwjriq2S1pKHAxULaUEAHacxClsQFnoECAYQAQ&usg=AOvVaw272ofreXqLUMgJuyeOgeaP, which has a fee of 0.12% and holds around 1500 stocks around the world.

It has produced an annual return of 8.88% for past 5 years. With around 73% of the portfolio invested in USA, 18% across Europe and UK, and 10% in Asia.

Now there are lots of ETF’s around which you can get from most investing platforms and they will have their own shortlist of recommended funds to select. These are 2 funds that I am happy to use.

With the reassurance that I can just switch off from and know that they will be safe and secure in both the good and bad times of investing.

Blue Chip Stocks – 20%

Now when I first started investing, I jumped straight into buying individual stocks what we call blue chip stocks in the UK.

As they have been around for numerous and considered safe and secure and will be around in many years to come. These shares consist within he FTSE 100, the top ranked market capitalisation shares listed in the UK.

Now I was happy to do this when starting out, and you may feel do also dependent upon your level of investment knowledge. If you confident in doing so, but this is a much riskier option. Based upon that specific company so remember to due your due diligence and background into the finances of that company before you invest and money into it.

Be aware that you may well make money or lose money you won’t get every investment decision right, so can you deal with the emotions connected to that certain stock.

Each company should then reward the shareholders such as annual, semi-annual or quarterly dividends based upon the company profits. Try to invest in companies that are successful and improve revenues, profits and dividends year on year. Also does that company have a moat or certain product that can’t be replicated easy by other companies.

A simple example is that it may have been around for 100 years and will still be here in another 100 years. But it adapts to current market cycles to stay ahead of the game and it’s competitors.

Remember to re-invest all dividends:

With regard to your portfolio, remember to re-invest all dividends back into those companies or new companies. You never had them before so you won’t miss them, so keep them within a tax-free wrapper to compound year on year.

So they will compound year on year and put all your stocks within a tax-free wrapper such as a stocks & shares ISA. Whereby all gains and dividends received are tax-free and don’t need to be declared to HMRC.

Some personal examples:

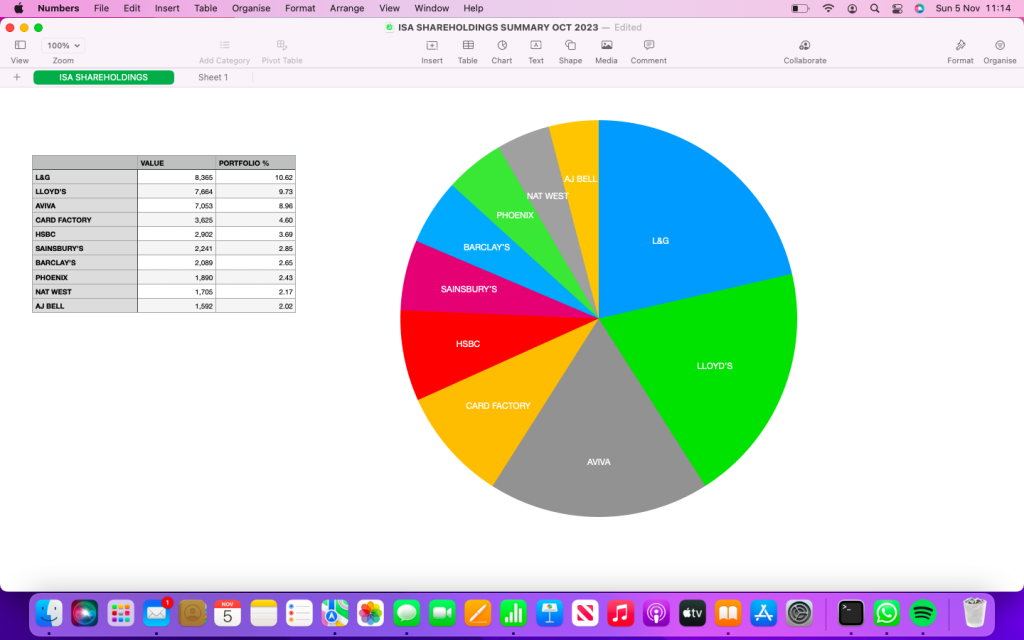

Now my own stocks & shares ISA is concentrated on 10 holdings within the UK plus ETF’s. With my largest holding making around 10% of my portfolio.

The companies I own include Lloyd’s Bank, Aviva, Legal & General, BP, Shell, HSBC, Sainsbury’s to name a few, but they are all well established, are all in profit each year and they pay good dividends yield which is normally increasing each year.

I am personally willing to hold a share for 5 years once purchased to save on dealing fees.

Growth stocks – 10%:

As your investment knowledge grows and you are happy purchasing individual stocks, you may venture further afield into so called growth stocks. Which are considered to be more riskier but can achieve a greater level of return by taking more risk.

Now these may be companies in the FTSE 250 or AIM which have started out small. They may grow rapidly over the past few years, based upon increased revenue and sales, acquisitions and mergers. These companies may produce excellent quality products which are in demand to the consumers at present.

Some examples:

JD Sports (ticker symbol JD)

Which is very cash rich and now has over 1 billion in cash reserves,. It did start out a small company based in the North west of England, but now has a global presence and operates in numerous companies around the world. Selling footwear and sports clothing but It has proved that a successful format online or on the high street, works in different countries.

In recent times it has expanded into USA and has just bought out Iberian Sports Retail for 543 million in cash, funded from its reserves. It does pay a small semi-annual dividend but is seen as a growth company and has doubled in value since I originally purchased that shares, and is now listed in the FTSE 100.

Greggs (ticker symbol GRG)

The baker, again started out as a small company in the north east of England but now is a major presence across most high streets int he UK.

During recent times the cost of living crisis has affected how we eat out, but the company offers a cheap option for takeaway food, is adapting it’s menu of a regular basis and has been expanding it’s present both on the high street and new ventures such as petrol stations food courts, train stations etc.

Again it proves that a good formula can replicated and prove to very successful, and it does pay an annual divided of around 60p per shares with a yield of 2.5%

These are just 2 simple examples of companies I have personally purchased in recent times, as a result of doing some research and background into.

You too can do the same, if you avoid so called penny stocks, but there are some great companies in the UK which the major investors may ignore as they have to track a specific benchmark or sector which they are aligned to.

So be prepared to do your own research and you could buy some unloved companies at a bargain price and hold them for several years and you will be rewarded accordingly.

Commodities – 10%:

As your assets grows along with your knowledge, you may buy what we call adventurous assets. It may be that you consider to buy precious metals such as gold or silver, now this may be in the form of a simple coin. You can buy a 1oz silver sovereign for about £ 30 in the UK which may be attractive or small investor or to dip your toe into that asset.

Or what about a gold sovereign starting out about £ 400. This may seem more expensive for a small coin or physical holding buy gold has been around for 1000’s of years’s and is considered a safe have n when times are tough, a see have seen during the recent conflict in Israel when gold went up by 5% overnight.

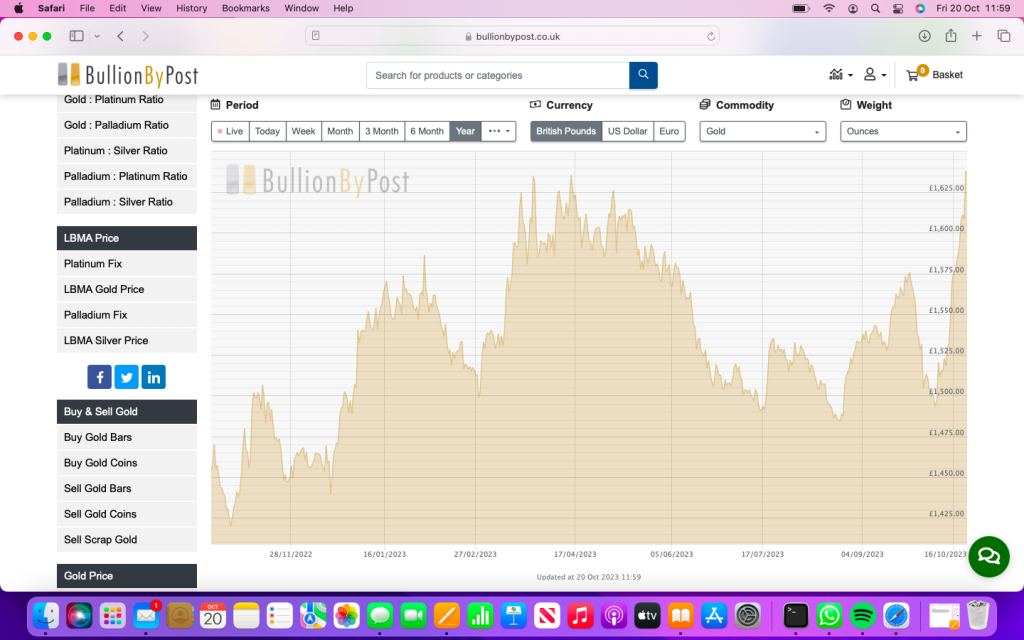

How has gold performed recently ?

As we can see from the follow chart, the price of gold has gone from 1,454 to £ 1,636 per Oz an increase of 12%

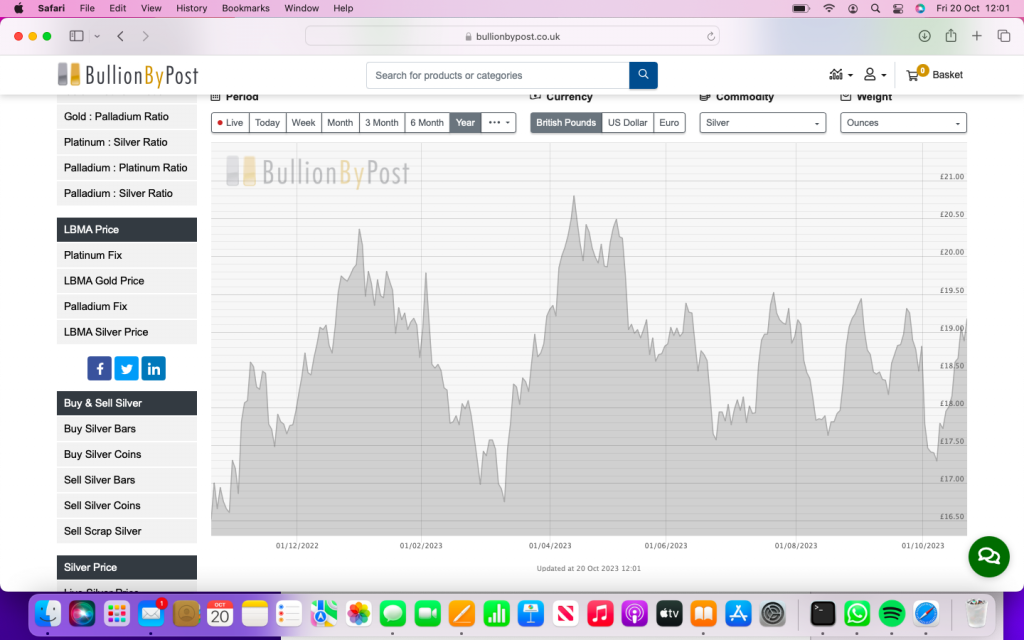

A simple option may be to purchase silver at a lower cost, again if we look at the following chart the price has gone from £ 16.52 to 19.17 per Oz an increase of 16% in a short timeframe.

Now I personally buy a 1oz silver Brtiannia coin each payday for around £ 30 and I intend to store them for many years to come, firstly to diversify my portfolio but secondly any profits or gains that I make will be free from capital gains tax.

This may appear to somewhat speculate but it is something I have started recently design 2023 and at present it makes up less that 1% of of total portfolio, but this is something I am happy to do as I’m considered a seasoned investor and am aware of the risks involved with holding this physical asset.

I personally use Bullion by post based in the UK to purchase gold and silver www.bullionbypost.co.uk. Other companies are available it just depends what companies you are happy to deal with and what services and products do they provide.

If you found the information in the above post useful, or wish to check out other posts about personal finances or pensions, then check them out on: www.moneyminted.co.uk

Be the first to reply