The idea of becoming an ISA millionaire may be a distant dream or reality for some people, but it is a distant possibility or viable scenario for most people.

According to recent information released there are 4850 ISA millionaires according to HMRC. The figure has been increased dramatically over recent years as people’s portfolios increase due to the effects of compounding. Plus some very good investment returns from stock markets in recent years. Even through we have suffered from the Covid Pandemenis and the Russia / Ukraine conflict.

So where do people generally hold their assets within substantial size portfolio’s:

Combination mainly in investment trusts, open ended funds or individual stocks.

If investing in cash you will receive lower investing returns and it will take considerably longer, to reach this figure. So you will have to invest in assets that produce a greater level or reward or return by taking more risk.

So how can somebody reach this milestone ?

- Learn to max out your ISA Contributions:

At present an UK individual can contribute £ 20,000 in each tax year (6th April to 5th April). This wasn’t always the case, it was originally a lower amount. But this amount or limit was introduced in 2017.

A simple example:

If you invested the full £ 20K each year at 8% annualised return, it would take you 21 years.

If you invested the full 20K each year at 5% annualised return, it would take 25 years.

Now, the idea of contributing the full amount each year may be unaffordable or unachievable for the average person. It proves that it can be done but the timeframe to reach such milestone will depend on 3 main factors, your level of contributions, timeframe, investment return.

There is no reason why someone starting out in their early 20’s could become an ISA millionaire by the time they are due to retire in their 60’s.

2: Invest early in the tax year.

It has generally been proven that investing earlier at the start of each tax year, has proven to give investors better levels of returns. As they are invested longer in the market. So your assets are growing for a longer period of time and benefits from the power of compounding. Generally the longer as asset such a share, fund is invested in the greater the reward.

3: Learn to invest on a regular basis.

If you are unable to max out your contributions at the start of each year, it may be that you contribute a set or specific amount each month on a regular basis.

I personally like to invest on the 1st of each month, it’s a simple solution to create through automated savings. Once you are that monthly habit or mindset, you will find that you don’t miss that money. So learn to pay yourself first, get into the habit of saving or investing on regular basis. Not the other way round, whereby you send all your money and if you are lucky, then decide to make ad-hoc payments if you have any remaining left ahead of the next payday.

If you do find yourself having an additional money, you then then allocate on a one-off or ad-hoc basis. But it will become more better for you if you become focused and disciplined in terms of investing regular.

You will then buy shares or funds through pound cost averaging. At markets or fund prices go up you will buy less shares or units. But if funds or shares prices drop you will then buy more assets at a lower cost. You will have good months and bad months as your portfolio will go up and down as you progress, but you will learn to understand how markets work and you will avoid short term market risk and volatility.

You will never be able to time the markets, even the greatest investors don’t get it right all the time. But it’s much better to have time in the market than trying to time the markets.

4: Pick your investments carefully

When starting out your investing knowledge may be very limited or concentrated on selected geographic regions or specific sectors.

Over time your investment knowledge and level of expertise will increase as you become more competent and investment minded.

As you start off initially, you may choose to invest in a simple low cost tracker fund. Which has very low costs and fees and will track the markets for you. Without the needs to do specific stock research. As you knowledge increase you then may venture into specific funds within a sector or geographic country. Or even may the odd investment into a specific stock or share.

But you will hopefully create what we call a well diversified portfolio. You don’t want to have all your holdings in the same types of asset classes or regions. Some you your funds will react to how that area is performing, and you have good and bad months and years within a sector. However, hopefully by spreading your investments across a number of different assets classes, you will reach your investment aims and returns.

A simple example:

For past 10 years the FTSE 100, (top 100 listed companies in UK) has given annualised return of 6.4%

For past 10% years the S & P 500 (top 500 listed companies in USA) has given annualised return of 11.3%

5: Set yourself investment targets:

The idea of building a portfolio to £ 1 Million, may seem daunting at first or beyond your reach, So break it down into manageable amounts or targets.

I personally set myself annual targets for the amount that I would like my portfolio to reach. Along with the amount of dividends that I would like to receive. Over Christmas, I will normally set goals for the next calendar year. My aim is also to try achieve an annualised return of 10% year on year. I know that I will have good years and bad years but I can see the progress that I am making. At the end of each month, I will then record and track the amount of my portfolio. So I can see what progress I am making.

When starting out, you may set some specific short and long term goals. It may be £ 1,000 or £ 10,000 but as you reach certain targets or milestones if you give you incentive to reach your next target.

At fist your portfolio may be increasing by small baby steps, but over time it will snowball through the power of investment return and the so-called snowball effect as it gathers momentum.

Also remember, if you are invested in funds try and invest in accumulation units so all dividends received are invested automatically back into your portfolio by your fund manager. Or if you receive dividends from a share or stock, re-invest then back into your holdings straight away through something called dividend re-investment. So next time you receive a dividend from that company it will pay a higher sum to you.

Key Point: All dividends you receive will remain tax-free and dividend tax year as long as you hold them in the ISA wrapper. So no need to declare to HMRC, saving unnecessary admin or having to declare or state on self-assessment forms. If you receive dividends outside the ISA, you can earn up to £ 500 each tax year before you are liable to dividend tax on the excess.

6: Leave your money invested and let compounding do it’s magic.

It is crucial to avoid short term thinking, so learn about delayed gratification. Consider why are investing in the first instance and what are your long term goals and investing objectives.

As you leave your money invested it will provide returns and growth year on year. Hopefully you have many years of positive returns v negative returns. Based on past history and previous performance, although not guaranteed. Investing in the stock markets has proven to be one of the most successfully forms of investing.

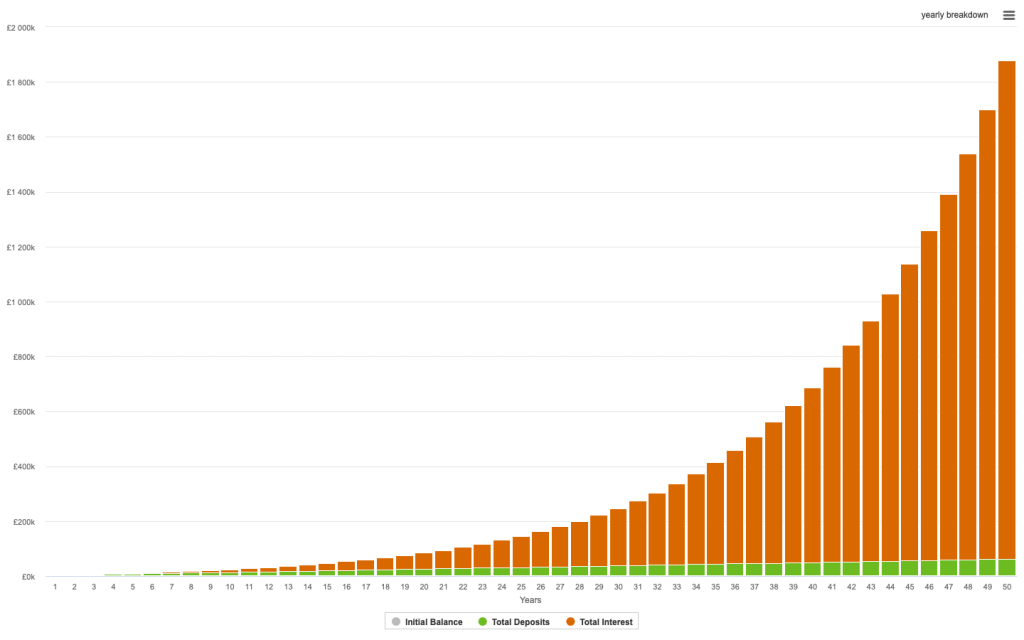

If you invest money in the first year, that sum of money will grow. In the 2nd year that money will grow along with any dividends received or new capital added into your portfolio. So it will grow faster. By the 3rd year, it will grow and further be enhanced due to new invested being added and receiving greater level of dividends within the portfolio.

(See simple comparison chart – showing how portfolio grows quicker in later years)

Finally !

Avoid short term market noise and sentiment, so called bad news published on a daily basis may have a very short term effect on your portfolio. So avoid short term noise and sentiment, some thing are out of your control, and you cannot do anything about it, So learn to keep calm and ignore it.

They may install fear when markets reduce due to bad news, or political events, but they won’t tell you that the markets will receive over the coming weeks. You may see it a a buying opportunity to increase holdings or buy shares or funds at lower price and hold for long term.

Also try and keep your costs down to a minimum amount. Don’t over trade your assets learn to trade infrequently and keep your costs low. You may choose to hold low cost tracker funds or ETF’s against actively managed funds which charge larger fees.

I personally buy funds for £ 1.50 each trade, not matter how big. Whether that’s £ 100 or £ 1000 it’s the same fee.

Another option, may be to buy shares or funds on a set date each month through regular investment day. If I buy shares in a specific company on any given day ir costs £ 11.99 per trade

So give some thought and consideration into what dealing costs you are paying each trade. What fees and charges your funds are charging you. It may not appear so trivial, but over time or as your portfolio grows your fees could have an adverse or detrimental effect on your portfolio growth in future years.

Remember !

If you like this blog post and found it useful or informative, please feel free to check out my other blog posts on https://moneyminted.co.uk which covers savings, investing, pensions and investment books that I recommended. So you can improve your investing knowledge, so you too

It’s not a get rich quick journey, but you will get there in the end if you create an action plans and think long term !

Be the first to reply