The idea of building wealth or creating a sizeable investment portfolio may appear daunting or investing at first, when starting out on your investment journey. With regard to the subject of investing it may be the hardest or biggest challenge you face.

Your end game may be to create a portfolio of £ 1,000,000 but break it down to bitesize chunks to make it appear achievable and obtainable. The vast majority of investors simply see this as an unreachable figure at first.

So let’s look at the some action steps you can take and an action plan so you can reach that milestone !

The 1st step is to take action today and to start investing, no matter how small it may be. So you can improve your financial net worth through wealth accumulation.

The world of investing may seem confusing or complex to a novice, as we aren’t taught how to invest through school education or in the workplace. So the vast majority of people don’t know how to invest in stocks, shares, ETF’s or different asset classes.

We all ultimately make excuses when starting out, such as they don’t have any spare funds as they may be living pay check to pay check.

1) I don’t know where to start, or they need a lot of money to get started.

2) I have to use a Financial Adviser who may charge them excessive fees, and they lose control over their money and where it is placed.

3) The world of investing may seem elitist to the rich or wealthy.

4) I’ll start next month or next year, when my current financial situation is in a better position.

Taking the first step is the hardest decision for most, but break it down into bitesize chunks such as £ 1,000, £ 10,000, £ 20,000 etc. So set yourself goals and targets to timeframes and it will spur you on towards reaching specific amounts.

What steps to take 1st ?

When starting out invest in simple low cost tracker funds or ETF’s at reduced costs which track a particular area of the market such as the FTSE 100 (UK) or S&P 500 (USA) or a global fund to cover all areas and to reduce investment risk and greater diversification.

Then as your knowledge and confidence grows consider single companies or stocks and different assets classes. But you can just switch off and avoid market noise and let your investments grow, with very little management and active involvement.

Learn to create a budget and a plan of action

Consider where you are going to get your investing funds from, so you can commit solely to investing. Will be your primary source of income, or overtime, a side hustle or a 2nd job. Remember when starting out, small changes in expenditure towards investing can have a great difference, even small amounts can add up when starting out.

Remember to put all your investments into a tax-free wrapper such as stocks and shares ISA, so any gains or dividends received are completely free from the tax man, this will prove beneficial as your portfolio increase as there is no need to declare any capital gains, or fill in a self- assessment forms to cover dividend income, it will also simplify your administration when running your portfolio.

Take advantage of free information on platform’s to assist you

There are lots of companies offering simple low costs ISA’s such as Interactive Investor, Youinvest, Freetrade, Trading 212 etc, so do your background into fees, charges, and investments on offer.

They will also have webinars and investment guides to help you on their platforms so take advantage of them. As part of your journey, don’t look at the market every day but do a review every quarter at least, I review my portfolio at the end of each calendar year.

Listed below is a simple graphic of how my stocks and shares ISA has performed in recent years.

- 2018 – worth £ 4,253, (investment return 5%)

- 2019 – worth £ 17,485 (investment return 29.32%)

- 2020 – worth £ 33,960 (investment return 14.54%)

- 2021 – worth £ 57,723 (investment return 18.90%

- 2022 – worth £ 71,352 (investment return -5.22%)

- current value – £ 84,991 (investment return 2.12% YTD)

Average return for past 6 years has been 10.81%, so we can see through the power of compounding how portfolio value is increasing year on year.

Plus the portfolio is now giving annual dividends of £ 2,400 which is increasing year on year also.

You will have good years and bad years with regard to investment returns, somethings are beyond your control, but the aims to think long term, as the market has normally returned around 8% since inception.

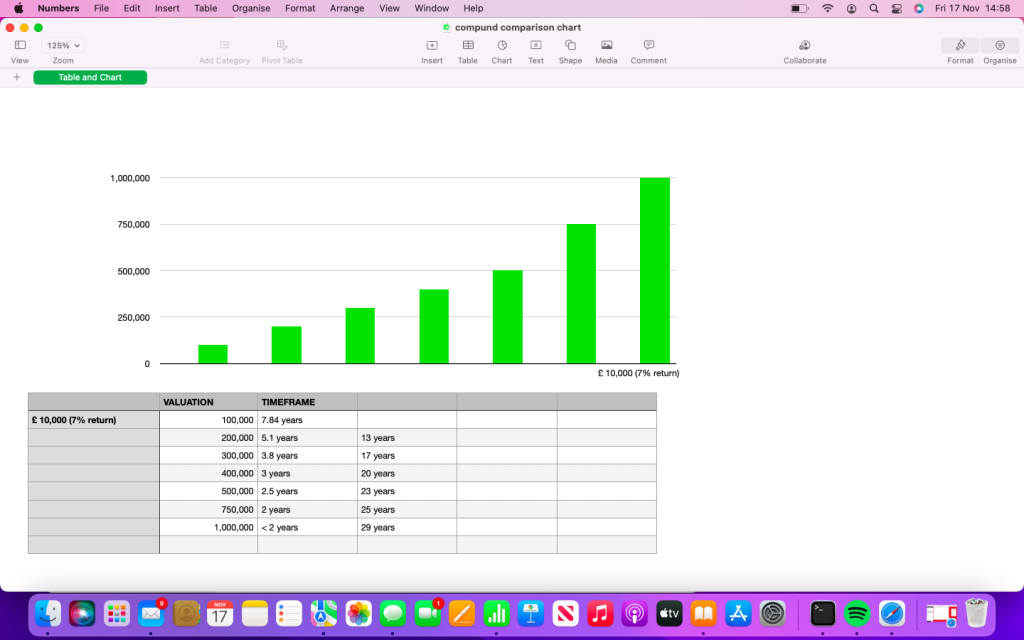

If we look at the following chart, we can see the real beauty of the power of compounding, let’s assume we invested £ 10,000 each year and received a return of 7% it would be worth £ 100,000 after 7.84 years.

Now 8 years may seem a long time, but investing should be considered as slow and boring and not a get rich quick scheme. Now once this figure has been attained we can see the power of compounding takes effect.

- If we look at the next £ 100,000 it would only 5.1 years to go from £ 100K to £ 200K.

- To go from £ 200K to £ 300K it would take 3.8 years

- To go from £ 300K to £ 400K it would take 3 years

- To go from £ 400 to £ 500K it would take less than 3 years.

- For portfolio to double from £ 500K to £ 1 million would only take 5 years.

This is a simple illustration to show the power of compounding but remember to consider fees and charges each time you invest.

Plus the more money you invest and the greater the return the quicker you will achieve your targets and end game, but if you invest less or receive a lower level of return it will take you longer to reach the targets.

There are lots of simple tools out there to help you so play around with the figures on a simple compound calculator. So we can see that the real returns of compounding takes dramatic effect when a portfolio is of a sizeable value like a snowball.

But the actions you take in the early years will greatly reward you in the later years.

Key Summary:

If you only take 1 thing from this post is that everybody starts from from zero in the same position as you, but keep hope and remain positive. You will have good months and bad months, and when starting out you may feel like you are making litter progress.

However though, remain focused and avoid short term market noise and think long term.

Remember to set your self some goals and milestones to a timeframe, which you may review regularly when you certain a specific target, but the journey should be enjoyable and rewarding. If you take the right steps and implement an action plan you can achieve your financial goals and aspirations.

Be the first to reply