The 1st rule of personal finance should be to eliminate unnecessary bad debt. Before you even consider the idea of saving, investing or trying to create wealth.

Most people struggle financially on a day to day basis, because they may be burdened with bad debts to fund day to day living expenses. Or purchasing big ticket items like cars, holidays, home improvements etc, which could be via bank loan, PCP deals, or credit cards.

At present the average consumer personal debt in the UK is £ 7,820

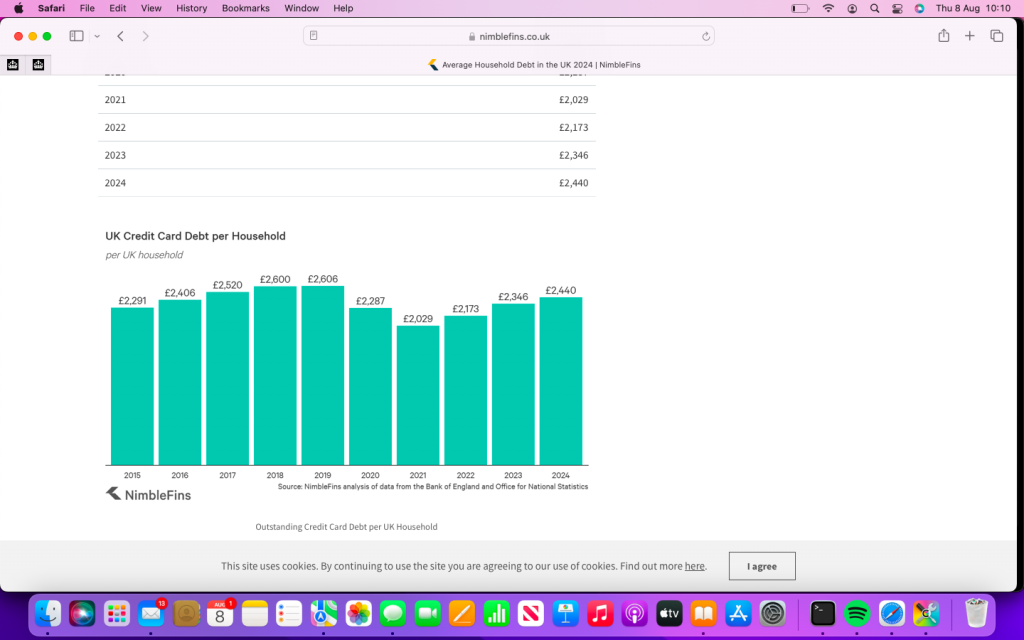

Average credit card debt per person: £ 2,440

Average student loan amount: £ 8,580

Avergage personal loan: £ £ 5,351

Average mortgage debt: £ 193,790

This problem unfortunately is only getting worse, as in the UK as a result of the recent cost of living crisis. We have 2 types of people:

- Those that are doing well and improving their finances moving forwards.

- People who are struggling on existing income and their debts may be put on hold, or increasing as payments aren’t being met. So their situation is getting worse.

Apart from the frightening numbers involved, the biggest stigma may be shame or our attitude to personal debt. For older generations it was quite simple it could couldn’t afford it you didn’t buy it. But now things have changed and we live in a consumer society, where everybody wants the latest iPhone, or flat screen TV, latest model or car, nice holidays. A lot of the time people may give the impression that they look rich, but in reality they are living pay check to pay check.

So what steps can you take to get out of debt and improve your financial situation:

No.1: Learn to understand your debt ?

Your starting point should be to do a list of your outstanding debts, e.g how much due you owe and to what companies or organisations. What sort of interest level are you being charged along with what the minimum statutory payments are required each month as part of the repayment plan.

Do a simple spreadsheet or chart, so you can build picture of whom you owe and how much. Along with the timeframe required to fully repay that outstanding amount.

If you only pay the minimum amount each month, the repayment will be extended past it’s original end date. Which could result in many months or years depending upon your level of repayments. So may an effort to try and repair more than the minimum sum required.

No.2: Get involved with your finances and do a simple budget

Again do a simple list of your income such a salary, part time work, bank interest, dividends that you receive.

Then list all your items of monthly expenditure, such as mortgage or rent, utility bills such a gas/elec, council tax, water bills, landline or broadband, TV licence all what we cover essential items that we have to pay for. Factor in any commuting costs to get to work or place of employment, plus household food expenditure.

Draw up a list on non-essential items such as petrol, insurance (car/life/home), eating out and socialising, daily coffees, clothes, holidays, subscriptions such as Amazon prime, Netflix, Spotify, Gym memberships.

What any any ad-hoc expense, such as birthdays, weddings, stag or hen weekends, family occasions, Christmas, school trips for the children.

You will be really surprised at where you are spending or wasting any money on so-called non essential treats or luxuries.

No.3: Reduce any unnecessary spending or luxuries.

Based upon the results of drawing up a monthly budget, are there any unnecessary items of expenditure you can eliminate or eradicate.

You may wish to do this pretty quickly to make an impact straightaway.

Got through your lines of expenditure in detail and consider which items are considered essential or are they a need or so-called luxury. So aim to cut out the fat and trim and undue expenses.

A simple example may be avoid so-called expensive food shops and consider a cheaper alternative, or when shopping draw up a list and only buy the items that you really need. You will become more disciplined before you make that purchase and you will be surprised at how a small adjustment can produce great results each time you shop.

What about any subscriptions that you have you may have become lapsed and you are still paying for. Do you really need Amazon Prime, Netflix, Spotify, and all the TV packages on offer.

Cut you shop around via comparison sites such as go compare https://www.gocompare.com/ or Quidco, https://www.quidco.com/, to save fees on your monthly expenses, such as TV, Broadland, Mobile phone, house and car insurance etc.

No.4: Work out what debts you have and the level of interest being paid

Do a simple list of what debts you have in the from of a simple spreadsheet so you can track. Including the amount, frequency of payments, end date or term, % interest rate payable.

There is what we call good debt and bad debts, a simple example mortgage rates have low rates over a long period of time, but credit cards and personal loans will have higher rates over a shorter period.

So for a mortgage you may be paying around 2% if on a fixed term deal, moving forwards you may be paying around 5% for new deals as interest rates have risen in past years.

For car loan or personal loan you may be paying between 5 to 10%.

For credit cards you may be paying around 20 to 25%

Could it be an idea to consolidate your debts to simplify them and make them easier to manage, or could you transfer credit card debts to a 0% deal whilst repaying. Some providers may charge you an admin fee to transfer, say 1 or 2% of the balance transfer, but it could save you money in the short term. Check what conditions apply if you did transfer and the fees and conditions place by new provider.

No.5: Get a debt repayment plan in place.

Most people may appear to pay off the minimum amount as per the rules and conditions on place with that provider.

But it will be more beneficial and cost effective if you made overpayments to reduce both the amount of interest payable and the term needed to repay any outstanding debts.

Make a point to clear any “priority debts“, if you don’t pay you could lose your home or essentials could be disconnected such a gas, electricity. It could be mortgage or rent payments, court orders and fines, council tax. Normally a provider will agree terms to recover any debts, rather than cutting any essential items, so if you are struggling to cover these bills. Speak to your providers directly to agree debt repayment plan to the satisfaction to both parties.

Once these debts are cleared, make it a aim or goal to clear any other debts such as credit cards, bank loans, car payments etc.

There are 2 strategies used to clear any debts being the snowball or avalanche methods. Whereby both methods require you to make minimum payments.

Snowball method: Whereby you pay of your smallest loans first to reduce the number of loans in place, once that is paid off then pay of the next smaller loan. You will do this action until all your debts are cleared off.

Avalanche method: Whereby you pay the minimum amount on each debt, but you use any extra money to clear outstanding debt with the highest level of interest payable. So the aim is to pay less interest to a creditor.

Both the above methods work, but you have to do what is right for you and your circumstances.

No.6: Improve your income or financial position

The idea of reducing expenses can only go some way to improving your current financial position. Many people are currently living to pay check and they may be unable to reduce any unnecessary items of expenditure as they cannot afford them in the first place.

A simple example may be that your income is static, but costs and bills are being increased by inflation. So you may be in a vicious cycle in that you may be constantly struggling to keep up with current costs, bills or essential expenditure.

One of the best things you can do is to improve your financial position, could you work extra hours in your current employment. Or you could take on extra qualifications to improve your employability, to maybe increase your salary with current employer. Could you speak to your current employer about possible opportunities to increase your income with them, you may well be surprised and they may fund you to undertake new qualifications or attend specialist training course. You may be surprised by their reaction, most employers will encourage you, they would rather keep good employee’s than lose them.

What about gaining a new job with a different employer on a higher salary ?

Could you take on a side hustle or get a part-time job to increase your level of income. It may be considered a sacrifice or you could go outside your comfort zone. But it may only be for a short period and it may excite you or create a passion for new opportunities in future. Could add another string to your bow and create greater options for employability in future.

No.7: Build a vision of your future self.

Imagine what you future self will look like in say 12 months time if you have no debt to repay. Could it alleviate a lot of undue stress in your life. What about improving your relationships with a partner or within the family. What about removing the constant worry of paying monthly bills or credit cards. Or having to worry each time things go wrong such as car breakdown and repairs. repairs and maintenance with your property. What about paying for school trips, or Christmas, birthdays, family events. Could it be that you use that money to go on a first holiday for many years ?

Try and vision for your future without having to make any debt repayments.

No.8: Ask for help !

If you are struggling with debts, don’t avoid them or bury your head in the sand. It will normally only make things worse. In general we don’t talk to others about our personal finances, and we may be embarrassed or could it a stigma to let others know about our current financial situation.

Don’t be frightened or nervous to ask for help !

There are lots of free advisers and orginisations to help you, clear your debts and improve your financial conditions.

Most companies such as energy providers, water companies, mortgage providers will supply contact details on monthly statements or online accounts providing details to contact them and agree debt repayment plans if you are struggling. They will have advisers who will work with you to reach a amicable solution for both parties. You will not be the only person in that predicament.

Could you take advantage or free organisations such as https://www.citizensadvice.org.uk who have offices locally or debt advisers who operate on telephone basis. Or what about specialist debt companies that are fee and impartial such as https://www.stepchange.org, or information on how to improve your financial knowledge, https://moneyhelper.org.uk. Which is free and impartial funded by the government which covers debts, savings, pensions to improve all round financial awareness.

No.9: Once out of debt – stay out of debt in future.

Once out of debt, make it an aim that you never get in that position again. Once you have taken the steps and down the hard work to improve your current position, don’t fall into that trap of spending unnecessary again. Ask yourself, before you think of buying that items do you really need it, what about not paying that decision and think about it for say 24 hours. You will be pleasantly surprised by your new level of discipline, before buying any items.

Consider it is essential, do you really need it and what improvements or difference will it make to your life in future. Learn about delayed gratification, we live in a consumer society. Whereby we are bombarded daily by adverts, billboards, e-mails all with the aim to make you buy unwanted purchases which most of us don’t really need.R

Remember the adage: people buy things with money they don’t have to impress people that they don’t even know. This is highlighted by the growth in tiktok and instagram socials put off by individuals today, that may appear to look rich. It’s normally the people that drive old cars and keep a low profile, that may be considered old school that are really the wealthy ones.

No.10: Create an emergency fund for future.

When you are out of debt and your finances in a better and sound position. Make it a decision to create a small emergency fund. It may only be a few hundred pounds to start with, I personally look to have £ 1000 in an instant access bank account. Which I can get in an emergency instantly, this could be to cover car repairs, maintenance on house, birthdays, family events etc.

Some financial experts or commentators may say you need 3 or 6 months as a cushion, but you have to get an amount that you are happy. I personally would rather that they money invested working for me, but we will also hold a slightly larger amount in my wife’s name also.

Remember !

If you like this blog post or summary, check out my other posts about savings, pensions, investments etc, so you too can improve your financial situation and education at https://moneyminted.co.uk

It’s not a get rich quick journey, but you will get there in the end if you create an action plan !

Be the first to reply