So how do you pick so-called good quality dividend stocks ?

The aim for any successful investor is to get the fundamentals of investing right. So you can improve your chances of success.

You don’t have to get every investment decision right. But it can limit your losses and number of failures.

Whereby, you will become successful and ultimately rich or wealthy over the long run.

So what can we do to improve our chances of success. Well following the key points highlighted below will improve that. Resulting in you reaching your financial goals and objectives.

So how does some one pick so called quality dividend stocks and shares ?

1) Firstly, don’t chase excessive yields

At present the FTSE 100 is giving an annual yield of around 3.77% . With 95 out of 100 companies paying a dividend. With the FTSE 250 is giving a yield of 3.25% with around 84% of this companies paying a dividend.

When looking at respective yields, see if the amount has stayed constant against it’s share price. Or has the yield increased recently or greatly reduced, if so find out the reasons why ahead of potentially purchasing.

Sometimes a company may pay out a higher yield compared to its peers. However, can that level be maintained without having a detrimental effect of future trading or the companies prospects. Maybe if a share price has fallen recently due to poor trading figures, change of management, or poor financial results.

To look at the background into yield’s, ex-dividend dates and past payments. You can find the details quite easily on the investor section on a company corporate section of their website.

A simple website I use to cover all companies is dividenddata.co.uk. http://www.dividendata.co.uk This website covers all UK listed companies along with investment trusts.

2) Keep all dividends in tax-free wrapper

Thanks to recent changes introduced by the government in budget of March 2023.

The idea of receiving dividends became a lot less attractive if not held within a ISA wrapper or outside a personal pension.

For 2022/2023 the annual allowance per tax year was £ 2,000 per individual, before it had to be declared.

But for 2023/2024 it has been reduced to £ 1,000. For the next tax year 2024/2025 it will be halved again to £ 500.

Who knows what will happen in future years. However, normally once allowances are cut and implemented they aren’t normally reversed.

The following tax rates apply to anybody over the annual dividend threshold:

Basic rate tax-payer – 8.75%,

Higher rate tax-payer – 33.75%

Additional higher rate tax-payer – 39.95%,

so it’s makes sense to try and avoid these costs and undue taxes.

At present every individual has an annual ISA allowance of £ 20,000 per tax year. For a SIPP or pension that figure is £ 60,000 or a lower amount equal to their salary. So take advantage of the tax-free wrapper in place, as they say “Use it to lose it”

Not everybody has the full amount to invest in that wrapper. It may be that your annual dividends are small when starting out.

That figure will soon compound over the years. A relatively small portfolio could generate £ 500 in payable dividends quite easily. If you are picking high yielding shares.

It pays to make the right steps when starting out to save any unnecessary declarations or payment of taxes at a later date.

3) Reinvest all dividends

It may be in the early years that your portfolio may be less than £ 1,000, and then may become say £ 10,000. After a short time and then possibly worth six figures in later years.

This will depend upon the level of contributions you add. The amount of dividends received and the rates of investment return, but your portfolio will snowball and compound over time.

On a personal level, if I receive more than £ 50 from a company. I will automatically reinvest back into that company, normally straight away through dividend reinvestment.

This is a simple option offered by most platform providers at a very low fee, my provider will charge £ 1.50 per trade. But it allows me to then hold more shares and receive larger dividend at the time of next payment. For any amount under £ 50 I will hold that within my account, until I invest at a later time. This is because the dealing fee may outweigh the benefits of purchasing a small stock amount.

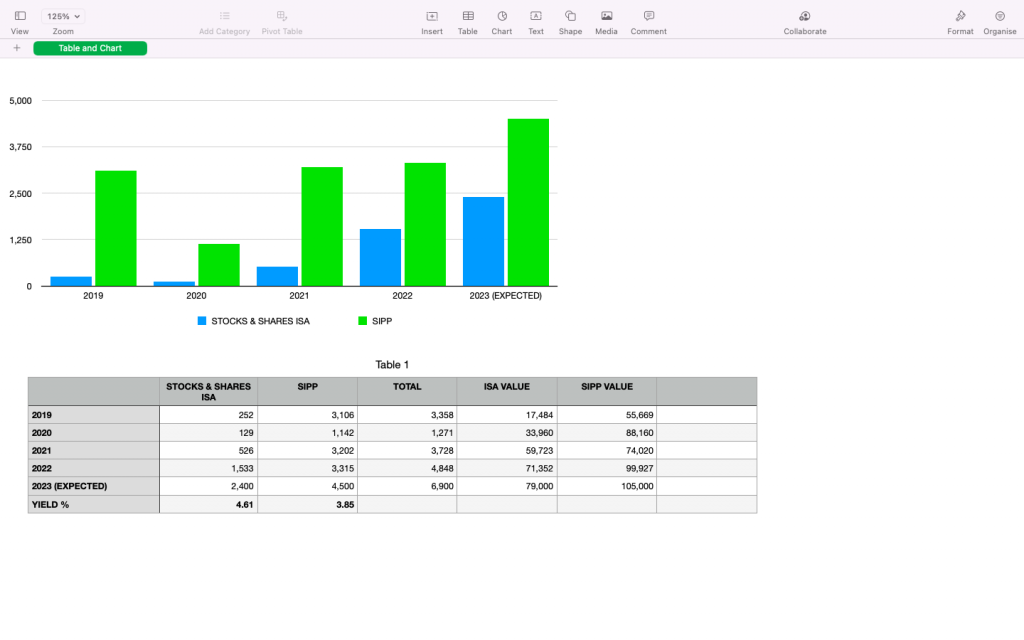

As we can see from the following charts. A simple graphic to show the annual dividends received from my ISA and SIPP account in recent years, due to the power of compounding. Remember to think long term and let the snowball effect take place.

4) Look at the payout ratio

Ideally payouts should be between 50% to 70%. These levels are considered appropriate to be distributed to shareholders. As some kind of reward for holding shares within a company of fund. These payouts will come from profits and retained earnings.

If a payout amount is considered excessive it may limit the amount it can reinvest into the business. Whereby to make it more profitable to or grow through acquisitions. Or spend via capital expenditure which may in turn limit future growth prospects and earning potential in future years. I ideally look for a payout ratio of no more that 60%.

An excessive ratio above 70% may be considered detrimental to the business and if the company. It could then suffer some kind of poor trading or downturn. Which may put the company in a difficult situation.

In uncertain times it may result in job losses, lack of capital investment. Resulting, on a downward spiral for future years.

If a payout is in excess of 95% it would be considered unsustainable. In future years, it may struggle to maintain at these levels. So ultimately 2 things will happen, the dividend will be cut or stopped altogether, which is no good to investors.

You ideally want to be investing into 2 types of good companies. The first being well established and have been around for many years, and will be around for future decades where the dividend is safe and secure. Or growth companies, that may pay out a small dividend now but is very profitable and will increase dividend year on year, but allows the company to grow at the same time.

5) Dividend Cover

The dividend cover is the number of times that a companies actual dividend could be paid out from existing earnings, measuring the proportion if distributable profit for the period as a dividend, compared to the portion retained for future growth.

So simply, if a company is making £ 100 million in net profit and pays out £ 50 million to shareholders the dividend cover is 2.

Ideally we are looking for companies with a payout in excess of 1, so any payments are not taken from retained earnings. Any figure below 1 should set some kind of alarm bells as it has to raid cash reserves to met current payouts. You should ideally be looking for payout in excess of 2 as this is viewed as highly healthy and sustainable, any figure below 1.5 may appear to be unaffordable if the company suffers any uncertain times in future.

So why is dividend cover so important, it provides an insight into how secure and safe the dividend is at present, and also how much of the profits are paid to the shareholders.

Some simple examples include BP & Shell with payouts over 4, and banks such as Barclay’s, HSBC, Lloyd’s, Nat West all with cover over 2.5.

AJ Bell or Youinvest produces a simple quarterly dividend dashboard newsletter, (only a few pages and can be found easily on their website) which provides great insight into dividends payments by the top listed companies in the UK.

6) Buy shares based on your attitude to risk

It may be that starting out you buy simple funds or ETF’s which cover and track the whole market or sector. Whereby they will hold every share within that sector or country.

As your investment knowledge grows you then may venture out into individual shares or stocks.

It may well that starting out you only hold a few shares, so don’t hold all your eggs in 1 sector.

The aim maybe to hold say 10 shares or numerous funds. So you can try and mitigate investment risk or create greater diversification in a portfolio.

But buy shares that you know about, stay within your circle of competence. Read and learn about companies through news articles, results and trading statements, which is easily available to find either directly on companies website or investment platform. Find out which companies are performing well at present and what companies may do well in the coming years, as a result of them having good market share or products in constant demand. Do your due diligence and research such as reading annual reports, shareholder updates before you invest any money into a share, and you will be rewarded over the long term by taking the right steps ahead of purchasing.

Simple examples may be companies expanding, or say the high street which shops are always busy, are people spending money on holidays, travel or more on leisure time or upgrading to the latest phone every so often. Are people spending money on big ticket items ? Or what about the employment sector you work in, do you have knowledge or insight about a specific sector which may be performing well.

7) Don’t panic sell

Remember the reasons why you are buying a share or fund in the 1st place. As any long time investor will tell you time in the market is more important than timing the market.

You will have good months and bad months where you portfolio may show a sea of red for losses for green for profits. A loss is only a loss on a screen or paper, it doesn’t become crystallised unless you sell that holding.

You will not get every decision right but think long term, no matter how seasoned an investor you are, but by taking appropriate steps when starting out, you can limit those losses.

The day to day markets swings are out of your control, but how you react to events and market sentiment will greatly improve your confidence and rational towards your long term goals. Learn to switch off from the market and don’t look at share prices every day, review say on a monthly basis.

If you have managed to invest at the low points during the recent pandemic you would be sitting on a very nice profit indeed.

Or sometimes a share price may decline because of the sector it is in, whereby all shares will go down, but some companies are better than others but they all react in the same direction because of a certain event or set of results. Could you see a downturn in a share price as a great opportunity to buy or increase a share that you already own or have been considering buying for some time and just waiting for the right price to buy at.

The market on average has increase around 8% year on year since records began, so use that as some kind of benchmark when you may do an annual review of your portfolio

The above points are a snapshot of some things that you can do to create a better dividend portfolio. By taking appropriate steps and doing research ahead of purchasing any investment, it will greatly improve your results and outcomes.

Remember if I can build a 6 figure portfolio so can you !

Be the first to reply