So how does somebody buy silver with the UK !

The thought of buying silver seems to be in the news on a daily basis, thanks to the recent surge in Gold and commodities. As we are constantly bombarded by news that GOLD is going Galactic.

Although the spotlight may be on the increase in the price of Gold over recent times.

Silver has always been seen as a poor relation and somewhat neglected. With any increase in it’s price following on it’s coat tails or a lagging factor, which takes some time to catch up and replicate.

Before you even think of why you are buying silver, ask yourself why are you buying it in the first place. Is it because of the fear of missing out (FOMO), get rich quick promises, or jumping on the latest investing bandwagon in search of a quick profit.

On a personal level: I have been buying silver as part of my long term investing strategy for the past 2 years. For the following reasons:

- a hedge against inflation – as commodities are seen as safe haven in turbulent times.

- not trusting central banks – as they can print fiat money which devalues paper money.

- an asset that can he hold outright – doesn’t have to be stored or held by a 3rd party.

- A way to diversify across new asset classes.

- If I purchase Britannia coins, they are considered CGT free on future sale.

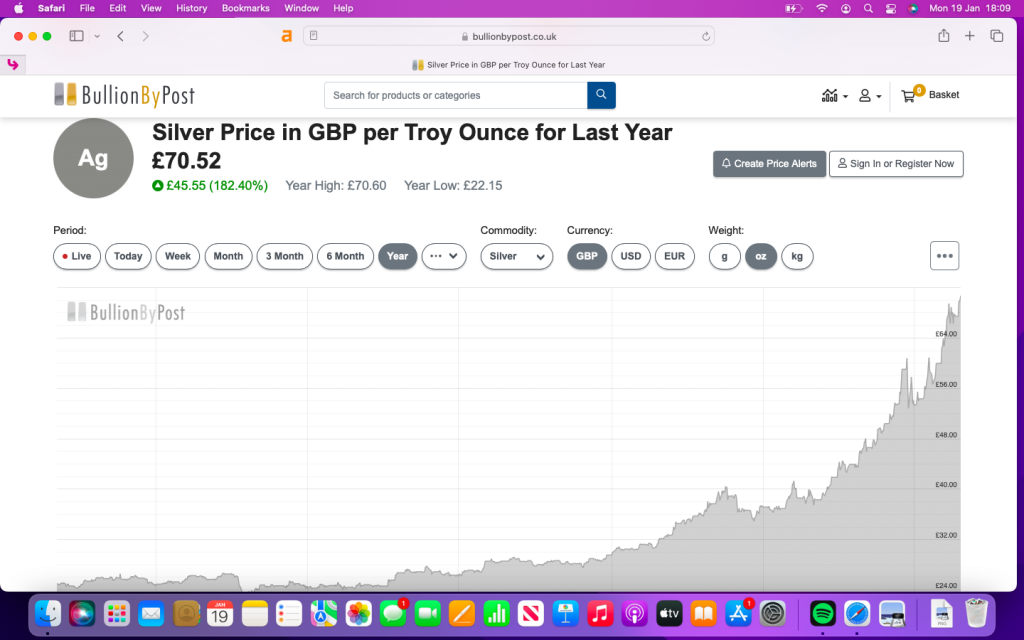

My journey of investing in silver started in June 2023 as it was seen as affordable to buy into to. In 2023 the spot price was £ 19.01 and the cost to buy 1oz Britannia coin was only £ 34.32

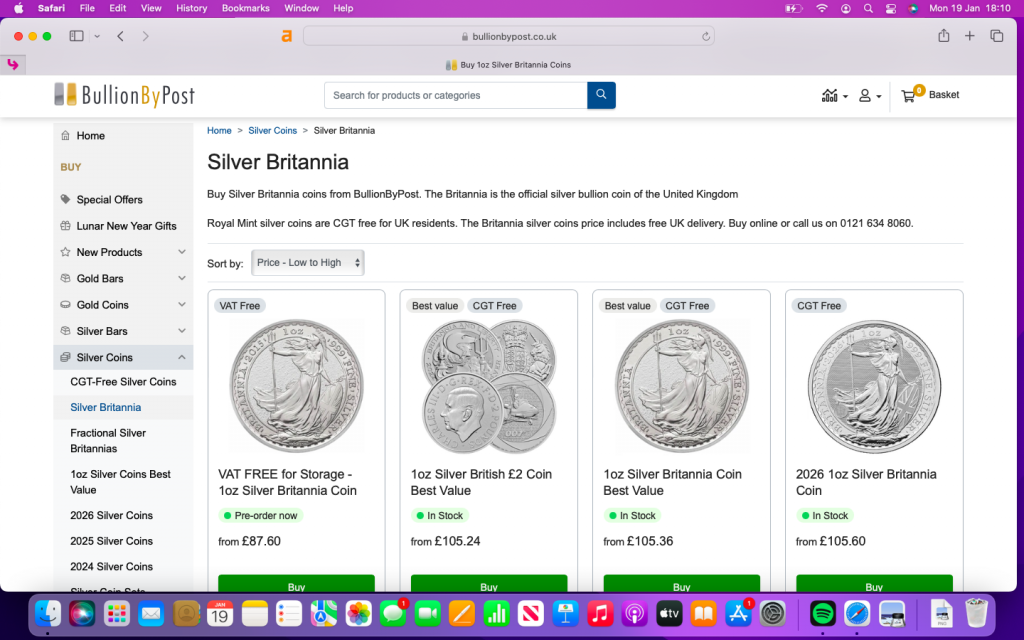

Fast forward to now the spot price is £ 70.52 with the price to buy 1oz coin now is over £ 105

The price rise in recent times, the rise has been unprecedented and spectacular.

A simple illustration the spot price went up by 22.87% in 2024, 115% in 2025, and 43% in 2026 (the course of 2 weeks as of mid-January)

So how does somebody buy silver ?

You have 3 simple ways to buy silver – you could:

- own silver physical yourself, or held in storage by a dealer or bullion broker.

- You could buy a portion within a ETC (Exchange traded commodities Fund)

- Or you may buy shares within miners or exploration companies listed on the stock exchange.

Buying physical silver

Using a bullion dealer in the UK, is a simple way that private investors can buy, store and sell physical silver at wholesale prices. With a premium added to the spot price added by the broker.

You can hold the silver physically yourself, it can normally be posted to you securely, within a very prompt timeframe. By owning it physically yourself, you can hold it at your own discretion and can lookout it whenever you want. Plus you can appreciate the beauty or aesthetics of the product, and you are free to do what you want with it.

If you purchase physical silver, you will have to pay VAT (currently 20%) on top of the purchase price, so the price will be increased.

Or you may choose to have the bullion held by a broker on your behalf. By doing so you won’t have to pay VAT on the purchase price. But you won’t hold the product directly. Plus you will have to incur storage costs to hold silver on your behalf. Which is normally based on the size of your holding.

If you choose to hold physical silver yourself, consider where you are going to store it. If you manage to build up a sizeable holding, where can you store it. What about insurance costs, would it create additional costs to your home insurance, as you may have to declare it (if a sizeable amount).

Or would you store it in a vault in a bank, lock-up or storage unit.

Either way, users can open an bullion account online or via our mobile app and buy silver in just a few minutes. The transaction should include live spot prices and is relatively simple to complete. You can sell at any time, allowing you to take advantage of changes in the silver market.

Be aware that short term prices can be volatile, so don’t see buying silver as a short term asset, as premiums are quite high over spot prices.

I personally use http://www.bullionbypost.co.uk, or you could use http://www.royalmint.com, http://www.bullionvault.com, although other providers are available. So before you do buy any silver, look at their websites, fees and charges, products on offer, deliver charges and reviews and testimonials.

Remember to allocate a small % of your overall assets when starting out dependant upon your attitude to risk and investment aims and goals.

At present, I invest into my SIPP, Stocks & shares ISA, workplace pension so my holding in silver is about 1% of my total liquid assets.

Buying through an ETF or ETC !

Exchange-traded trust funds (silver ETFs), or exchange-traded Commodities (ETC’s) track the silver price using complex derivatives, and may not even be backed by bullion.

Be aware, as dealing may be restricted to stock-market hours, and the trade may be done on a daily basis. The annual fee will vary between funds, but it is usually around 0.5% to 1%. Which is charged directly by the fund manage on a regular basis.

This way may be more affordable to beginners when starting out as you can trade fractional shares or units. You may start out by investing small amounts on a regular basis and as you get more confident, you can increase the amount or trade more frequently.

One downside by choosing this option, is that you don’t physically hold actual silver. You are effectively holding an number of units or shares held with a fund.

To see what fund are available look at the options offered by a bullion broker or dealer. Or if you are investing within an ISA or trading account, your platform provider should offer a good selection of recommended funds.

For my stocks and shares ISA, I use http://www.youinvest.co.uk, again other providers are readily available. So compare funds across numerous platforms and providers, but make sure that your funds are held within a tax-free investment wrapper.

Buying shares in silver miners listed on the stock market

To buy silver mining stocks, listed on the stock market. You would normally have to open a brokerage account (like a Stocks & Shares ISA or Trading Account (GIA) in the UK).

Such companies and individual miners (include e.g., Fresnillo, Hochschild Mining, Endeavour Mining, BHP, Rio Tinto). By holding physical shares in a company, you actually own a small stake intuit company. With the aim and reward that the company will boom and create greater profits as the price of commodities rise. So the share price rises and produces gains or profits.

Along with the prospective payout of any dividends paid to shareholders for investing in that company. These could be paid quarterly, or semi-annually to individual shareholders.

As the price of silver rises, the profits and margins should also increase. So the likelihood that shares prices will increase will dramatically improve.

But be aware if the price of silver will fall, then it may have an adverse effect, whereby profits will be lower, the dividend may be cut and the share price could fall.

So again before committing any funds into a particular company or share. Do your background checks into news, trading figures, press releases and previous results.

Or spread your funds across numerous shares, so you aren’t reliant on any 1 particular company.

Again start off small, and increase your holding or allocation as you become more confident. And remember to place any shares within a stocks and shares ISA, so dividends and growth are tax-free within the investment wrapper.

Greater information can be found about listed companies on http://www.londonstockexchange.com or your platform provider.

To reiterate some key points:

- Clarify the reason why you want to invest in Silver

- Do you hold it yourself or through a broker on your behalf

- What costs will you incur if you do hold the silver yourself or with a 3rd party

- How long do you plan to hold it, and it can be volatile in the short term.

- Are you buying Silver to diversify, or as some kind of safe haven asset

- Do you pick numerous funds or shares, to reduce your risk

Remember:

If you found this blog post useful and informative, please check out my other blogs covering pensions, savings, investing and investment books I recommend on http://www.moneyminted.co.uk. So you too can improve your investing knowledge and you can reach your investment goals and dreams.

The world of investing should be rewarding and you will achieve your long term investing plans. If you create a plan and think long term.

Be the first to reply