This is a common question asked recently as people are people bombarded with radio advertisements, news articles, tv adverts, social media ads about the price of gold going galactic.

But why is this specific class of asset having such a meteoritic rise in recent times. Are we in some kind of bubble and will it last or is it a short term market fad or trend.

So why do people generally invest in gold ?

Gold is seen to be considered a safe haven in so called troubled times, it is often called the “emotive metal“. Which divides opinion across investors and the public. Gold has been around for centuries as an old trading currency and will continue to around for many years in future. However though, the uses or reasons for its existence and general daily use has changed in recent years as people generally use cash in the forms of currency to trade and buy items.

So why has the price of gold increased dramatically in recent times ?

Well the central banks have been seen to be stockpiling it and storing it. They have reduced their exposure to certain assets such as the US dollar which was always seen as the ultimate safest form of investment. As it is fully protected by the US government and was seen as the gold standard for reassurance.

In recent years we have seen heightened geo-political risk and conflict across numerous countries. Such as Russia / Ukraine, the Middle East, worsening relations between major superpowers such as USA and China.

A simple example: China has greatly been reducing its holding of US dollars in recent years and it has been investing that money in Gold. A similar action also does by other countries such as Poland, Turkey, India to name a few. They have become net buyers adding to their reserves, It is believed they have bought collectively over 1000 tonnes each since 2022. Whereas in previous years they were buying around 481 tonnes as an average.

This action has obviously resulted in the US dollar losing value in real terms, so all this done is reduce the price even further. Which results in countries buying even more as it appears a better form of investment hedge in safer times.

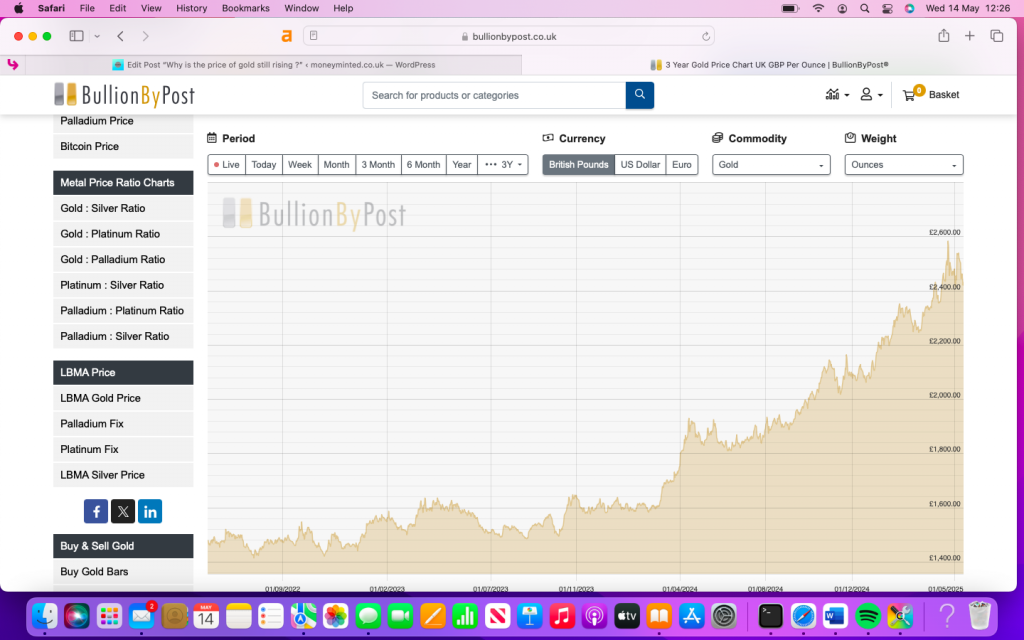

Gold price chart for past 3 years – showing dramatic rise over recent times.

As we can see price increased by over 27% during 2024 from £ 1637 to £ 2080 per ounce.

For 2025 year to date, (as of 14th May) the price has now increased to £ 2424 per ounce so increase of 16%

Check out my Youtube video:

https://youtu.be/QRztEYqOMhM

Are people jumping on the bandwagon – it is a short term bubble ?

Many years ago the idea of the public buying gold wasn’t really an option. It was always seen as being somewhat elitist to the very rich and wealthy. Now times have changed and it is very simple to buy physical gold online in a matter of minutes. Whereby you can hold it yourself or in a vault with an online broker.

Social media has also had a great influence and there is an abundance of information and help out there to enable someone to buy a small piece of gold quite simply.

What are the pros and cons for holding gold as an investment !

Firstly the pro’s for holding:

- has a long history and track record, what is seen as a sustainable and beneficial asset.

- is considered very liquid, can be easily traded or exchanged.

- has a limited supply, only around 216,000 tonnes have ever been mined or extracted from the ground.

- the annual rate of extraction is only growing by around 1% each year

- has got a very good long term investment return

- It can be used to preserve capital or wealth during uncertain times.

- certain types of bullion is capital gain tax free within the UK.

What about any potential con’s:

- It can be considered volatile if holding over the short term period.

- Doesn’t produce yield, interest on its original investment

- Price can be dependant on what the buyer is willing today you

- Can be expensive to store yourself at home or if you use a vault or storage box for somebody to hold on your behalf.

- Are you happy holding such a valuable asset on your premises, what about the cost of insurance if you do manage to hold sizeable amount.

- It uses or applications are considered limited, may be used for jewellery etc.

So how does somebody buy gold or physical assets ?

You could choose a simple and cheaper option by buying a simple ETF tracker through a broken held within an ISA wrapper. You will pay a small fee to trade or purchase respective units and sometimes a small management fee on top. Most platform providers will have a list of funds available that cover this specific sector.

Or you could choose to hold shares of the companies that extract and mine gold, in the UK such companies listed include:

Fresnilo: https://www.londonstockexchange.com/stock/FRES/fresnillo-plc

Rio Tinto: https://www.londonstockexchange.com/stock/RIO/rio-tinto-plc

Antofagasta: https://www.londonstockexchange.com/stock/ANTO/antofagasta-plc

Glencore: https://www.londonstockexchange.com/stock/GLEN/glencore-plc

Or you could own physically where you purchase actual gold through an online broker.

You could a company such as http://www.bullionbypost.co.uk, which is considered to be the no.1 online bullion dealer within the UK.

Disclaimer: Other reputable companies are available within the UK, buy this is a company that I personally use. I don’t buy gold through them, but I do purchase 1oz silver Britannica coin each payday. It can be done online via a simple transaction in a matter of seconds, and the coin is delivered to me the next day free of charge. They have great tools, charts and advice on their website to help people getting started into buying and holding gold or other precious metals, they can even store (VAT free) for you via vault such as brinks in Zurich.

I invest a small amount each month around £ 35 to buy each 1oz coin, and intend to hold onto them indefinitely and may even pass them onto my family in future. But my total holdings is less than 1% of my current liquid assets, so its a way of diversifying but its only a tiny % of my overall assets. One major positive with this type of purchase is that any gains are considered capital gains tax free.

So could this so-called bubble burst ?

No investment is regarded as fully safe and secure, and you will have good years whereby you will see positive returns and some years that will have negative returns. But the idea is not to trade and time the market but to think long term. Ask yourself what are you investing in gold in the first instance and does it form parts of your investment risk, strategy and objectives to improve your wealth or financial situation, in the coming years.

Future predictions: Some analysts and forecasters reckon the price may fall significantly in the coming months. The consensus it that it may go as low as $ 2000 over the next few years. This are only predictions and estimates, but it shows that a downward price trend is predicted. Is the idea of a drop in prices seen as a time to increase holdings.

How would you handle or react to a severe drop in value if you do decide to hold these assets, could you afford to sell at a loss. Does it fit in your with your investment aims or appetite to risk and speculation. It may be that you do invest but it only forms a small pot of a well diversified portfolio.

Remember !

If you like this blog post, please feel free to check out my other blogs on investing, pensions, personal finance at https:moneyminted.co.uk. So you can improve your investing knowledge, whereby you can reach your financial goals and aims.

It’s not a get rich quick journey, but you will get there in the end if you create a plan and think long term.

Be the first to reply