They are an organisation set up to fight their injustice over the increased age, that they become entitled to the Uk State pension.

It is believed that millions of women in the UK have been adversely affected by the increase in the state pension by recent governments in power.

The changes affect women born in the 1950’s who weren’t supposedly informed by the relevant bodies. That the age they were due to recent their Uk state pension was being increase in future years.

They have created their own campaign body and greater information about them can be found on their website being: https://waspi.co.uk

So how did this so called injustice occur ?

Firstly, the current Uk state pension was introduced way back in 1948. It was based upon an individual paying national insurance contributions. Whereby men would receive their state pension at age 65 and women at aged 60.

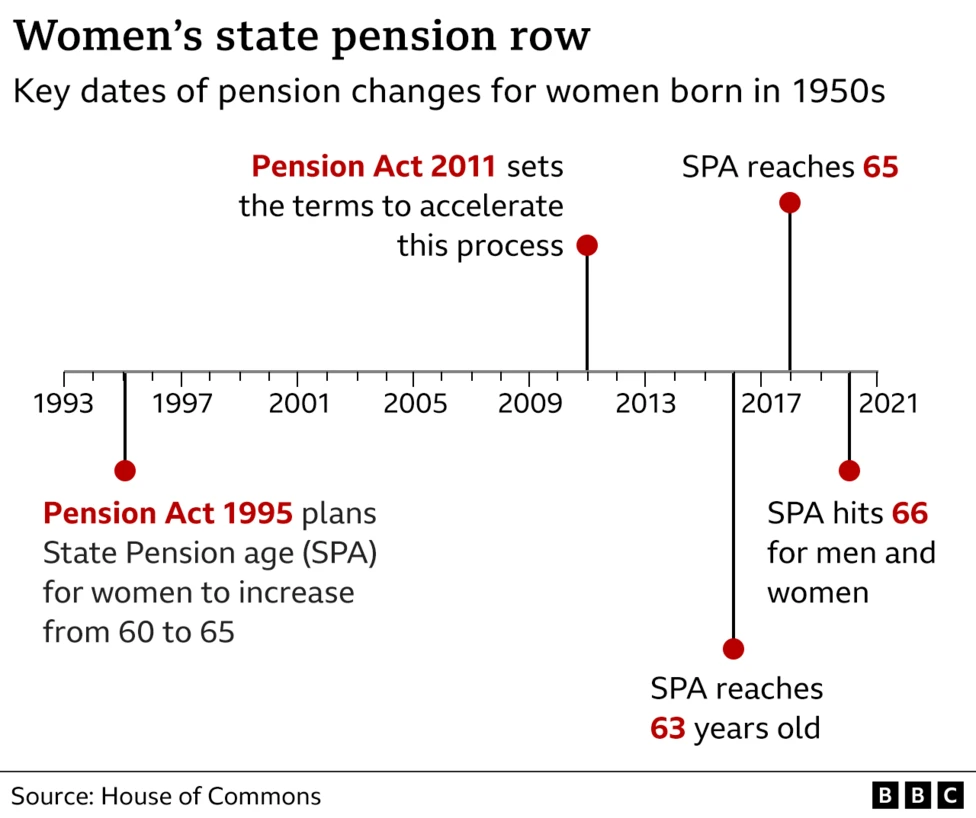

However though, in 1995 the Conservative government who were in power. Introduced a new timetable to equalise the age that men and women would both receive the state pension at the same age.

So the age of entitlement would gradually be increased to age 65, between the years 2010 to 2020.

But this timetable took a dramatic twist, when the then Conservative-Lib Dem coalition government. Decided to speed up the process moving forwards. As the future cost of maintaining the state pension was rising and becoming somewhat unaffordable.

So, the Pensions Act 2011, was introduced to bring the new qualifying age for women to new age of 65 with effect from 2018.

Then in 2020, the state pension qualifying age for both men and women would be increased to age 66.

The rules will be changing again in future, at present it is anticipated that the new qualifying age will be 67. This will be done gradually between 2026 and 2028, dependent on your date of birth.

What about future years ?

Again under current legislation, it will increase in future to age 68, between 2044 and 2046. It was meant to be reviewed every 5 years, but this been put on hold as it’s no a vote winner. The last review (as part of the Pensions act 2014) was started in 2017. Which advised that the current state pension age should be brought forward by 7 years. So new changes could be introduced between 2037 and 2039. These new dates have yet to be confirmed or agreed by law.

Greater information can be found at http://https;//gov.uk/government/news/state-pension-age-review-published (effective 30th March 2023)

So how many women are affected ?

It is believed that around 3.6 million have have adversely affected by the decision to increase state pension age to age 65.

With 2.6 million of them affected by the new timetable introduced to 2018.

What is the aim of their campaign ?

The WASPI women are not against, or oppose the equalisation of the new state pension age for both men and women. But it is about the poor communication from the then current government over the changes being implemented. With many stating that they weren’t informed of the new changes, or those that were aware were given inadequate notice. So they were late or unable to make changes to working lives in the following years.

It seems that many of these women were unprepared so they had to continue in employment, for longer than initially planned. Or their level of lifestyle was severely affected, which has resulted in a lot of undue financial worry, stress, anxiety or insecurity,

Their aim of setting up the action group was created to achieve some kind of financial award, compensation or recompense to put them in the correct financial situation.

The figure originally suggested was around £ 10,000, as a collective cost it was estimated to be around £ 36 billion.

What has been the recent reaction from the Conservative government ?

The Parliamentary and Health Service Ombudsman (PHSO) stated in March 2024. “That the government had failed to adequately inform thousands of women that the state pension age had being changed”.

It was suggested and highlighted that an amount between £ 1000 and £ 2,950 should be offered as some form of compensation. An amount far below what the WASPI women were looking for.

Although an amount was suggested, it was not enforceable by the government to be duly awarded and implemented.

As recently as December 2024, Liz Kendall (the Works and Pensions Secretary), stated that the WASPI women would not be entitled to receive any compensation. They did however accept that there has been some form of maladministration, that had taken place when addressing what communication should have been sent out to respective individuals.

Has things changed with introduction of recent Labour government ?

The current chancellor Rachel Reeves has stated “given the vast majority of people did know about these changes. I don’t consider that the it would be the best use of taxpayers’ money to have to pay out an very expensive compensation bill”

This action and response seems to contradict what they said before coming into office. They did support the WASPI campaign, but they did stop short to agreeing to commit any form of compensation. As part of it’s general election manifesto.

How can I find out details about my state pension entitlement ?

The amount of state pension that an individual is entitled to, is based upon when you were born. Along with the number of qualifying years of national insurance contributions you have made.

If you have made at least 10 years NI contributions, you will be awarded some state pension amount. If you have managed to contribute 35 years, you should be awarded the full amount.

If you received state pension before 6th April 2016, you should be received the old rate – currently £ 169.50 per week. This will be increase to £ 176.45 per week from April 2025 (as per annual increase.

If you reach state pension age after April 2016, you should receive the new rate – currently £ 221.20 per week. This will be increase to £ 230.25 per week again from April 2025.

You may have to create a gateway account, via www.gov.uk. so you can access your actual NI record for yourself.

Or you can contact the Future Pension Service, https://www.gov.uk/browse/working/state-pension, or you can call them on 0800 731 0175.

To check your date of state pension entitlement, you can use the following link: https://www.gov.uk/state-pension-age

Remember !

If you found this blog post useful and informative, please feel free to check out my other posts on https://moneyminted.co.uk. Which cover pensions, savings, investing and recommended investing books. So you can improve your financial and investing knowledge, to reach your financial goals and aims.

It’s not a get rich quick journey, but you will get there in the end if you create an action plan and think long term.

Be the first to reply